Real Estate Making an investment For Starters

Real-estate expenditure can be an exceptional strategy to increase your wages supply, but before scuba diving in it's important to carefully take into account numerous factors like schooling, time, links and self confidence.

Add real estate property ventures in your expenditure portfolio for several advantages. They could branch out and decrease risks.

Purchasing a Home

Novices in real residence making an investment should turn out to be informed about their options and also the a variety of techniques for starting up. There are numerous kinds of property purchase prospects, which includes acquiring or booking components and also purchasing REITs each house wholesaling and every may require far more operate according to its complexness, but each one is great ways to start real estate purchase.Residence acquiring for real estate expenditure is probably the easiest and most successful techniques offered to property investors. By browsing out components ideal for restoration within your local area at affordable prices, purchasing them and redesigning them quickly you are able to get into real estate property purchase without experiencing massive down payments or restoration expenses. When you are evaluating properties to purchase it's also wise to take into account your potential audience: for instance working on homes near excellent university districts or park systems may help slim your concentration considerably.

Turnkey rental qualities provide another methods of buying real estate property. These one-loved ones and multifamily residences have already been remodeled by a smart investment residence firm and are prepared for rent, causeing this to be method of real-estate buy ideal for novices minus the sources to renovate components on their own.

Real estate property making an investment for starters provides a number of appealing advantages, one particular being its capability to produce cash flow. This refers back to the web earnings after mortgage payments and functioning costs have already been subtracted - it will also help deal with home loan payments when reducing taxes due.

REITs and crowdfunding offer two feasible expense alternatives for first-timers planning to enter real-estate, respectively. REITs are real estate property investment trusts (REITs) traded on carry swaps that very own and manage real estate property attributes these REITs offer a safe strategy for diversifying your stock portfolio although helping meet up with fiscal goals more rapidly than other forms of committing. Furthermore, their price ranges can be purchased for relatively modest sums of capital producing REITs a great method to begin committing for novices.

Buying a Business Residence

When purchasing professional home, traders should keep in mind that this particular type of investment can vary drastically from purchasing home real estate. When deciding on where you are and considering the threat threshold and function for investing, nearby zoning regulations must also be considered for example if making use of it for enterprise take advantage of this can effect resale beliefs as well as lease probable.In contrast to non commercial real-estate assets, making an investment in business qualities requires increased risks and needs considerable investigation. They are usually complicated with higher income requirements in comparison with one-family houses moreover, there might be a variety of charges for example loan charges, house taxes, insurance costs, maintenance estimations, managing service fees or maintenance estimates - these expenditures can quickly mount up it is therefore very important that this professional evaluates the current market well before shelling out.

Start your career in industrial house involves making use of the experience of the knowledgeable agent or realtor. They may help with discovering a home that best suits you and price range, and help with homework operations as needed. Just before buying a house additionally it is necessary to understand its nearby tax legislation consequences as well as understanding how to determine cap price and cash flow computations.

You can find six principal ways of making an investment in property: straight purchase, REITs, REIGs, real estate syndication and crowdfunding. Each method of real estate property expenditure has its own group of positive aspects and challenges when choosing 1 you must also determine if you plan to buy/turn/handle/outsource the job.

Being a novice in actual real estate making an investment, a smart approach might be to start through the use of current value as make use of. This method helps save both money and time because it removes the hassle of locating deals yourself whilst providing you with exposure to business specifications prior to purchasing your very own qualities.

Investing in a Rental Residence

Among the best real-estate shelling out methods for novices is purchasing hire properties. Leasing out residence gives an effective way to produce residual income although potentially turning into extremely profitable even so, newcomers should take into account that buying lease property can be high-risk endeavor. They ought to conduct a thorough industry and site examination prior to making any final judgements as an illustration they should look at factors such as crime rates, college areas and saturation of supply stock with their location simply because this will let them prevent dropping funds or overpaying for qualities.First-timers in actual estate purchase should find smaller, more secure assets as being a beginning point, like investing in a one-family members house or condo within a secure local community. They need to try to find qualities with likelihood of long-term development to grow their expense stock portfolio gradually as time passes.

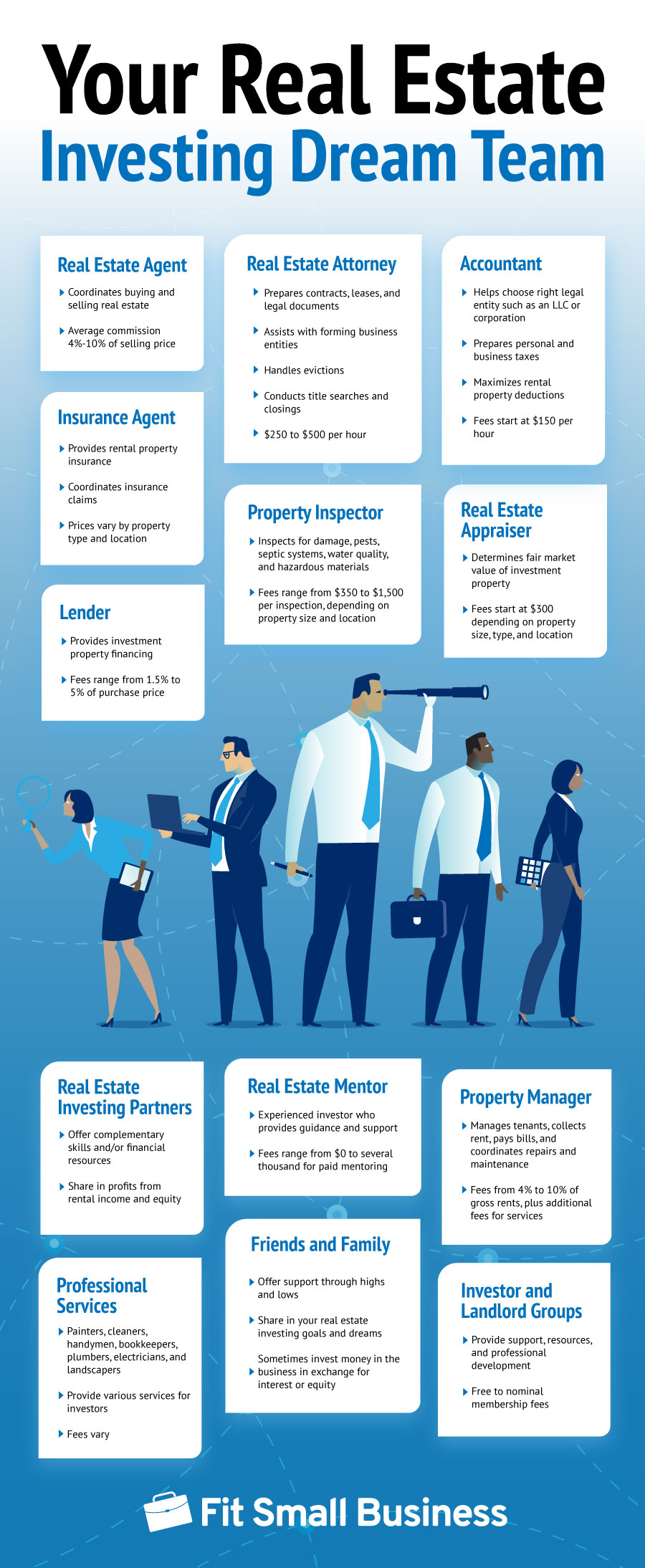

Understand that property investments need both effort and time to successfully manage. As this could be demanding for starting buyers, it really is very important they have use of a support network comprising home managers, legal professionals, an accountant, contractors, and so forth. Additionally, newcomers should participate in as numerous networking events as possible to meet other specialists inside their sector and look for their area of interest.

Finally, having a comprehensive plan for every residence you own is key. Doing this will enable you to keep track of income inflow and outflow linked to rentals as well as when it may be beneficial to fix up or upgrade them - ultimately supporting maximize your return.

Real estate can seem to be such as a daunting obstacle, however its benefits can be large. Not only can real estate property give you continuous channels of income but it is also a fantastic diversifier for your personal pension account, lowering how to invest into real estate risk by diversifying from shares that accident while often charging less than other long-term investments.

Getting a REIT

REITs supply traders usage of real-estate while not having to obtain individual attributes, although giving better yields than classic repaired revenue investments like connections. They are often a very good way to diversify a portfolio however, brokers should make sure they fully understand any associated hazards and choose REITs with founded path data.There are several forms of REITs, each and every making use of their very own set of unique attributes. Some concentrate on home loan-backed securities that may be highly erratic others individual and manage professional real-estate like offices or shopping malls still others individual multiple-family lease apartment rentals and constructed real estate. Particular REITs are even publicly exchanged on inventory exchanges letting traders to directly purchase reveals other nonpublicly traded REITs may be available through exclusive equity funds and brokerages.

When deciding on a REIT, ensure it offers a eco friendly dividend that aligns using its profits past and administration group. Also take into account the potential risks included including achievable home benefit decline and rate of interest modifications along with its full come back and every quarter benefits together with its once-a-year working revenue.

REITs typically distribute dividends as regular revenue rather than capital results on their traders, which may demonstrate useful for people in lower taxes brackets. It's also well worth recalling that REITs may offer you better options than direct real estate committing for newcomers to real estate property investing.

NerdWallet can assist you pick an REIT suitable for your investment requires by looking at brokers and robo-advisors online, taking into account service fees and minimums, expense alternatives, customer service capabilities and mobile app features. Once you see one you enjoy, REIT acquisitions may start just remember they're long term purchases which need monitoring periodically additionally mortgage REIT prices often go up with soaring rates of interest this pattern tends to make mortgage REITs especially erratic assets.